In the modern business world, especially in the digital age, cross-border payments have become a routine part of everyday transactions. If you’re a freelancer, business owner, or online seller, managing payments across different countries and currencies can be complicated. Payoneer provides an easy and efficient solution to this challenge. Let’s dive into what Payoneer is and how it can streamline your payment processes.

What Is Payoneer?

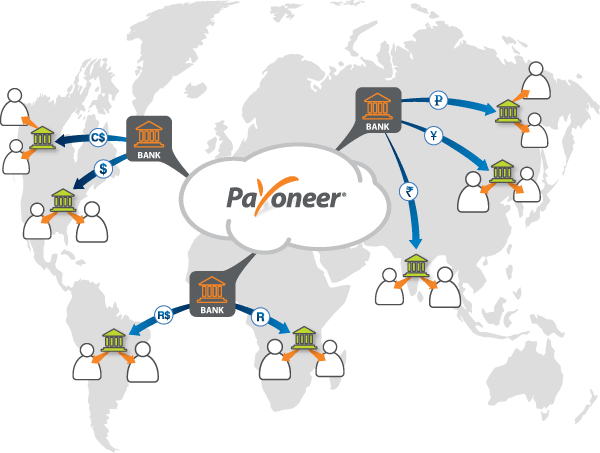

Payoneer is an online payment platform designed to help businesses and individuals send and receive money globally. Whether you are a freelancer, an entrepreneur, or a large corporation, Payoneer facilitates seamless international transactions by acting as an intermediary between you and your clients or suppliers.

What makes Payoneer stand out is its ability to handle payments in various currencies without the usual high fees associated with international bank transfers. It offers businesses and individuals a fast, secure, and cost-effective way to manage cross-border payments.

Key Features of Payoneer’s Payment Service

1.Global Reach: Payoneer enables users to send and receive payments from over 200 countries and territories worldwide.

2.Multi-Currency Support: Payoneer allows you to hold and transact in multiple currencies, including USD, EUR, GBP, and more, making it easier to manage international funds.

3.Prepaid MasterCard: Payoneer provides a prepaid MasterCard that you can use to make purchases both online and in-store. You can also withdraw cash from ATMs globally.

4.Team Access: For businesses, Payoneer lets you grant multiple users access to your account, making it simpler for teams to manage payments collectively.

5.Easy Marketplace Integration: Payoneer integrates with a wide range of global platforms such as Amazon, Upwork, and Fiverr, making it convenient for freelancers and e-commerce sellers to receive payments.

6.Currency Conversion: Payoneer offers competitive exchange rates, minimizing the cost of converting currencies when dealing with international payments.

How Does Payoneer Work?

Using Payoneer is simple and straightforward. Here’s a step-by-step breakdown of how it works:

1.Sign Up: To get started, create a Payoneer account by providing your business or personal information. After registration, you’ll receive a Payoneer account number that acts like a local bank account for receiving payments.

2.Receiving Payments: Payoneer gives you a virtual account for receiving payments from international clients. This means that you can receive payments in local currencies, and Payoneer will convert the funds into your preferred currency and deposit it into your account.

3.Sending Payments: Payoneer also allows you to send payments to other Payoneer accounts or to bank accounts in various countries, saving you on conversion fees and providing a more flexible payment method for your international transactions.

4.Withdraw Funds: Once your funds are in your Payoneer account, you can transfer them to your local bank account or withdraw them using the Payoneer prepaid MasterCard.

Why Should You Choose Payoneer?

1.Lower Fees: Unlike traditional banks or other payment processors, Payoneer offers lower transaction fees for cross-border payments. This can significantly reduce your overall costs when handling international payments.

2.Wide Global Network: Payoneer has a broad reach, which is ideal for businesses that operate globally or freelancers who need to handle payments from clients in different parts of the world.

3.Secure and Reliable: Payoneer uses advanced security measures to ensure your transactions are safe and your financial data is protected, giving you peace of mind when managing payments.

4.Fast Payment Processing: Traditional bank transfers can take days to process, especially when it comes to international payments. Payoneer speeds up this process, often completing transfers within a few business days.

5.Scalable for All Business Sizes: Payoneer is suitable for both small freelancers and large corporations. Its flexibility makes it an ideal choice whether you're just starting out or expanding your business globally.

Conclusion

Payoneer is a powerful tool for anyone looking to simplify international payments. Whether you're a freelancer working with clients across the globe or a business expanding into new markets, Payoneer offers a reliable and efficient solution. With its low fees, fast transaction processing, and secure payment methods, Payoneer makes handling international transactions easier than ever.

If you're looking to streamline your payment process and expand your global reach, signing up for Payoneer could be the right choice for you.